Investing in low volatility international stocks is often used as a defensive strategy by investors who want to participate in some of the market’s growth while potentially reducing their downside risk. Our research has found, however, that traditional low volatility strategies may introduce unintended sector concentration and interest rate risk, among other challenges.

In this paper, we explain how screening Developed Markets ex-U.S. stocks for quality, as well as their relative volatility, may help address those problems and create a defensive strategy that we believe offers greater upside capture and less downside risk. 1

THE HIDDEN RISKS OF LOW VOLATILITY INVESTING

Over the years, equity investors have learned that they must accept short-term fluctuations in stock prices in pursuit of potential long-term gains. Still, for many investors it can be difficult to stay invested in equities when the value of a portfolio declines sharply during a market downturn. In response, some defensive-minded investors are including exposure to stocks with lower relative volatility in an effort to help diversify their portfolios and potentially minimize those fluctuations— giving up some upside potential during positive markets in exchange for reduced downside risk during market declines.

Over the years, equity investors have learned that they must accept short-term fluctuations in stock prices in pursuit of potential long-term gains. Still, for many investors it can be difficult to stay invested in equities when the value of a portfolio declines sharply during a market downturn. In response, some defensive-minded investors are including exposure to stocks with lower relative volatility in an effort to help diversify their portfolios and potentially minimize those fluctuations— giving up some upside potential during positive markets in exchange for reduced downside risk during market declines.

Yet low volatility strategies may come with tradeoffs. They may have high portfolio turnover, as price movements can cause certain holdings to exceed targeted volatility limits. There also are risks to low volatility investing that aren’t immediately apparent. Our research suggests that traditional low volatility strategies have historically resulted in unintended sector concentration. Compounding this concentration risk, some of these sectors—such as utilities and consumer staples— tend to be most negatively affected by rising interest rates. As a result, traditional low volatility strategies may provide less upside capture and less downside protection than investors anticipate.

APPLYING THE LENSES OF RELATIVE VOLATILITY AND QUALITY

The FlexShares Developed Markets ex-US Quality Low Volatility Index Fund (QLVD) is designed to provide exposure to Developed Markets ex-U.S.-based companies that are designated as Large or Mid Cap, possess lower overall absolute volatility and that also exhibit financial strength and stability, which we believe are quality characteristics.

The FlexShares Developed Markets ex-US Quality Low Volatility Index Fund (QLVD) is designed to provide exposure to Developed Markets ex-U.S.-based companies that are designated as Large or Mid Cap, possess lower overall absolute volatility and that also exhibit financial strength and stability, which we believe are quality characteristics.

The Fund tracks the Northern Trust Developed Markets ex-US Quality Low Volatility Index2 and Northern Trust Investments Inc. (NTI) is the investment adviser for FlexShares ETFs.

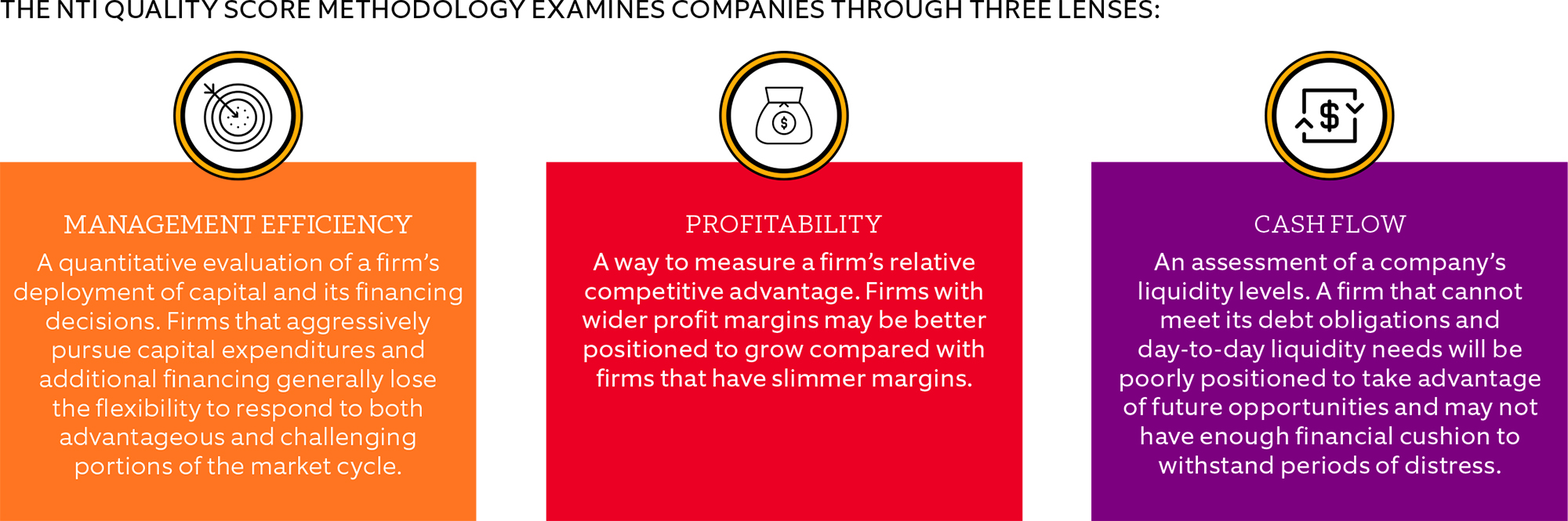

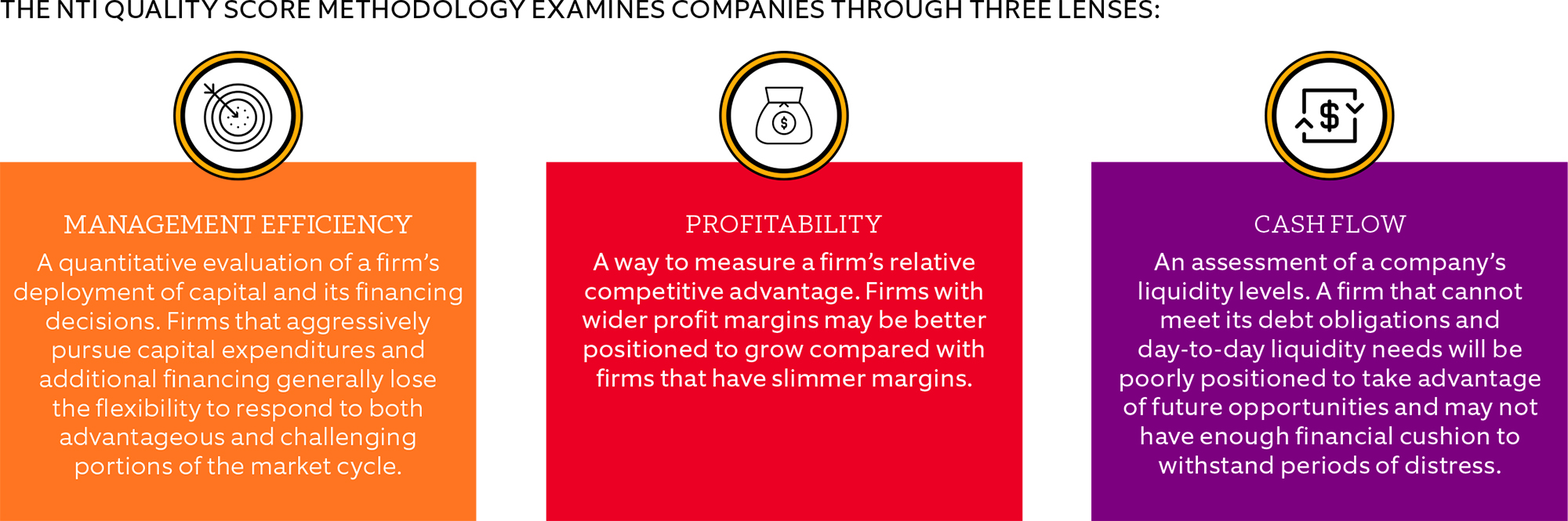

NTI starts with the Northern Trust Global Index 3, which represents approximately 97.5% of world’s float adjusted market capitalization. Then, they exclude all U.S.-based companies and apply a multi-faceted Quality Score (QS) to measure a company’s core financial health.

Based on these characteristics, each company’s stock receives a quality score and is assigned to quintiles, with quintile 1 representing the highest-quality companies and quintile 5 representing the lowest. The index eliminates all stocks in quintile 5, based on evidence that low-quality companies historically have exhibited higher volatility.

Next, the index employs several rules that we believe help create a properly diversified portfolio, including maximum overweights/underweights for any single stock, industry, sector, region or country. The index also targets a portfolio of securities with a historical beta4 of 0.65%, which due to historical research suggests that the stock has been 30% less volatile than the overall market. Another rule limits portfolio turnover to 12%.

Finally, NTI optimizes the index by applying a quality tilt to the overall portfolio. This step helps confirm that there is a good representation of low-volatility stocks that also are from the higher quintiles in their respective sectors.

TARGETING IMPROVED RETURNS AND STRONGER RISK MANAGEMENT

In our view, a good defensive strategy shouldn’t come at a greater cost than necessary to an investor’s long-term return targets. Our research suggests that using a quality screen during the index construction process may capture more of the market’s upside potential while protecting against downside risks.

In our view, a good defensive strategy shouldn’t come at a greater cost than necessary to an investor’s long-term return targets. Our research suggests that using a quality screen during the index construction process may capture more of the market’s upside potential while protecting against downside risks.

What’s more, we believe that the index’s diversification controls may help avoid overweighting interest-rate sensitive sectors such as utilities and consumer staples. Together, these results suggest that applying a quality lens to a low volatility strategy may help to further diversify a portfolio and reduce volatility—without sacrificing returns.

CONCLUSION

Low-volatility strategies can be a helpful defensive strategy for investors who want to reduce potential portfolio declines during market downturns, while still capturing some of the gains that come during positive markets. We believe that the FlexShares Developed Markets ex-US Quality Low Volatility Index Fund (QLVD), which incorporates our research-driven findings about the role of quality in a stock’s potential volatility, can help investors meet their risk management and capital appreciation goals.

FOOTNOTES

1 The up-market capture ratio is the statistical measure of an investment manager’s overall performance in up-markets. It is used to evaluate how well an investment manager performed relative to an index during periods when that index has risen. The ratio is calculated by dividing the manager’s returns by the returns of the index during the up-market and multiplying that factor by 100.

2 Northern Trust Developed Markets ex-US Quality Low Volatility Index is designed to construct a high quality universe of companies that possess lower overall absolute volatility (i.e. risk) relative to an eligible developed market universe which excludes the United States. An emphasis is placed on a company’s income and capital growth, while also reducing overall volatility of returns relative to the eligible universe.

3 Index’s coverage encompasses both developed and emerging markets worldwide.

4 Historical Beta is the coefficient term of the regression of a security versus the market, and is also a measure of the systematic, non-diversifiable risk of a security or portfolio. Beta represents the market sensitivity, relative to a given market index and time period. For example, a security exhibiting a beta of 1.0 indicates that the security has the same sensitivity as the market index it is being compared to, while a security with a beta of 1.5 would indicate that the security has 1.5 times the sensitivity of the market index.