Investors have long looked to infrastructure stocks for their potential to diversify portfolios, generate income and respond to inflation. But infrastructure investments have also historically come with unique risks, including sensitivity to regulatory and political impacts, as well as natural disasters. We believe the key to managing these risks lies in broadening the scope of an infrastructure investing strategy across geographies, sectors and even revenue types.

In this paper, we offer a closer look at the unique benefits and risks accompanying infrastructure investments. We then explain the methodology that the FlexShares STOXX® Global Broad Infrastructure Index Fund (NFRA) utilizes to add potential breadth and diversity to the portion of an investor’s portfolio that is dedicated to infrastructure.

THE CHALLENGES OF INFRASTRUCTURE INVESTING

As the world’s population grows, virtually every country faces pressure to upgrade existing infrastructure or launch new developments. We believe that this trend may offer an opportunity for investors seeking to diversify their equity portfolios and generate income that tends to react positively to inflationary threats.

Because infrastructure is often an essential service in various economic environments, historically stocks in that asset class tend to have predictable cash flows. Returns are typically sheltered from inflation, since infrastructure operators often pass cost increases to their users. Infrastructure stocks also have historically produced returns that are less correlated with other asset classes.

However, we believe that infrastructure investing requires a careful approach. Our research also suggests that many traditional infrastructure funds tend to focus on well-developed countries, overlooking potential opportunities in developing markets that may help diversify an investor’s portfolio. What’s more, the large size and long duration of many infrastructure projects potentially puts an additional premium on diversification, as these projects tend to be capital-intensive and susceptible to risks related to regulations, political activity and even natural disasters.

We believe a successful infrastructure investment strategy may help address these risks and allow investors to take advantage of opportunities in developing markets by broadening the definition of infrastructure to capture:

THE FLEXSHARES SOLUTION: A BOTTOM-UP APPROACH TO DIVERSIFIED PORTFOLIO CONSTRUCTION

The FlexShares STOXX Global Broad Infrastructure Index Fund (NFRA) is an ETF that seeks to broaden its portfolio by tracking a custom index, the STOXX Global Broad Infrastructure Index.1 STOXX is a leading index provider in Europe, owned by the Deutsche Borse, which operates the largest stock exchange in Germany, and the SIX Swiss Exchange, the leading independent stock exchange in Europe.

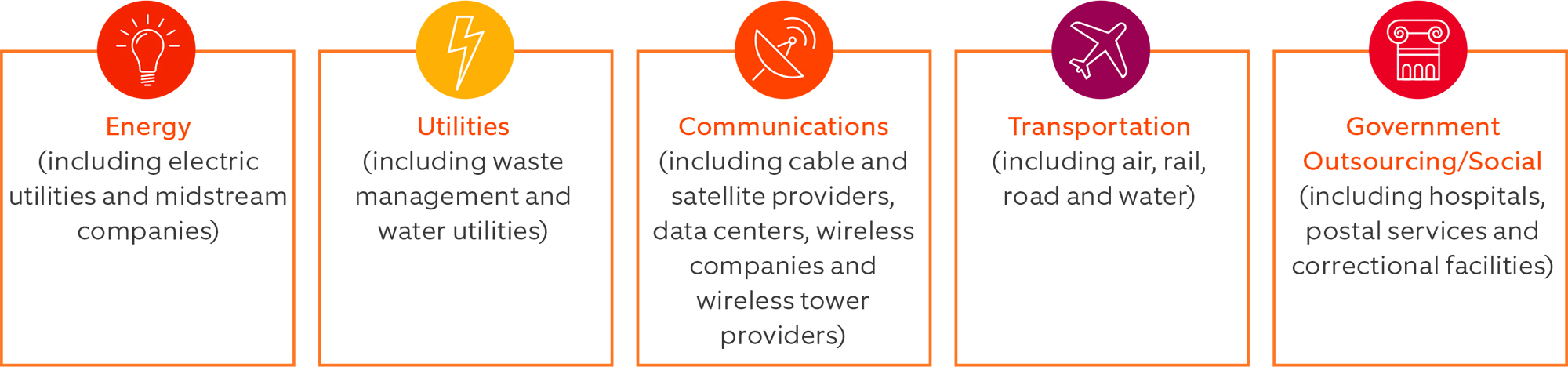

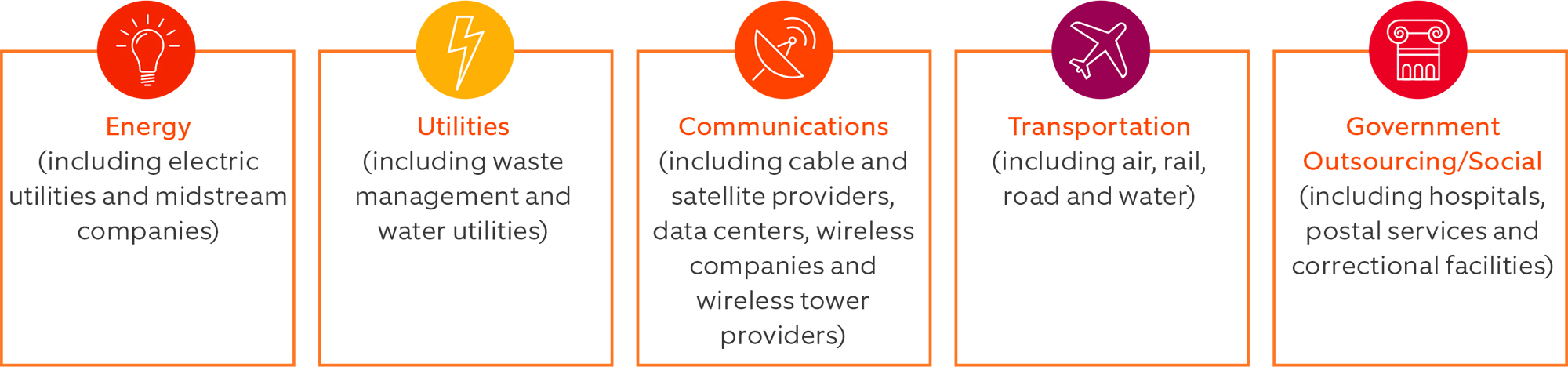

Starting with the STOXX Developed and Emerging Markets Total Market Index2 as the universe of investable companies, a screening process that includes bottom-up supply chain analysis helps identify companies that historically derive at least 50% of their revenues from five infrastructure supersectors:

The index is further refined by requiring that all stocks have a three-month average trading volume of at least $1 million. To maintain diversification across the portfolio, the index also adheres to weighting constraints such as:

Maximum investment of 5% in any individual security;

Maximum investment of 30% in any supersector; and

Maximum of 40% in any country

IMPROVED CATEGORY DEPTH AND INTERNATIONAL DIVERSIFICATION

Our research suggests that this approach to index construction provides broader diversification that offers both potential risk mitigation and exposure to new and evolving players in the infrastructure space. Incorporating a bottom-up approach may improve category depth by identifying more potential investments than those found through traditional top-down sector categorization alone. Balancing investments across the five infrastructure supersectors is intended to help the index avoid large concentrations in traditional infrastructure sectors such as utilities, while providing global diversification in one infrastructure solution.

CONCLUSION

While infrastructure investments can be attractive to investors seeking inflation-protected income and portfolio diversification, they may carry risks that require a breadth of diversification that we believe has historically been difficult to achieve. Most infrastructure indices limit the scope of their holdings by following a top-down selection approach, resulting in heavy concentrations among traditional infrastructure sectors and less exposure to infrastructure investments in both developed and developing markets.

We believe that the FlexShares STOXX Global Broad Infrastructure Index Fund (NFRA) provides investors broader access to the evolving global infrastructure market. At the same time, it offers diversification across multiple dimensions to help mitigate the risks common to infrastructure investments. This approach is designed to offer a combination of potential risk mitigation and true global diversification that can help investors pursue their goals of portfolio diversification and income potential, along with potential protection against the risk of long-term inflation.

FOOTNOTES

1 The STOXX Global Broad Infrastructure Index measures the performance of companies that generate at least half of their revenues from 17 sectors defined as infrastructure-specific by a proprietary classification system used by STOXX.

2 The STOXX Developed and Emerging Markets Total Market Index represents the world’s Developed and Emerging Markets as a whole, covering approximately 95 percent of the free float market capitalization of the investable stock universe with a variable number of components.7 Standard deviation is a statistical measurement; when applied to the annual rate of return of an investment, it sheds light on the historical volatility of that investment. The greater the standard deviation of a security, the greater the variance between each price and the mean, indicating a larger price range.