High yield bonds have advanced from a specialty fixed income investment to a strategic, mainstream asset held across most diversified portfolio allocations. Once viewed as being the “penalty box” for wayward public debt issuers, over the years the sector has transformed into a dynamic, competitive marketplace for capital raising and refinancing. A multitude of forces were needed to bring high yield out of the shadows and into the spotlight. Now the sector is ready for a further evolution that combines earlier high yield principles with new techniques to again deliver truly high income strategies for today’s investors.

In this paper, we discuss some of the changes that are affecting the high yield bond market. We then describe how the FlexShares High Yield Value-Scored Bond Index Fund (HYGV) uses a multi-factor approach to select and weight securities, which we believe offers the potential for improved diversification and income generation.

FOCUSING ON YIELD

The evolution of high yield has been supported by low market interest rates, tight credit spreads, shifting norms in corporate financial management, regulation, changing investor risk tolerances and new portfolio construction models. High yield investing has grown, matured and transformed over the decades into a familiar but distinctly different asset class.For an investor, a fixed income high yield strategy focused on yield may seem oxymoronic. After all, historically fixed income plays two important roles in a portfolio – diversification and income generation. Additionally, income generation, by definition, is a function of yield.

The evolution of high yield has been supported by low market interest rates, tight credit spreads, shifting norms in corporate financial management, regulation, changing investor risk tolerances and new portfolio construction models. High yield investing has grown, matured and transformed over the decades into a familiar but distinctly different asset class.For an investor, a fixed income high yield strategy focused on yield may seem oxymoronic. After all, historically fixed income plays two important roles in a portfolio – diversification and income generation. Additionally, income generation, by definition, is a function of yield.

For an investor, a fixed income high yield strategy focused on yield may seem oxymoronic. After all, historically fixed income plays two important roles in a portfolio – diversification and income generation. Additionally, income generation, by definition, is a function of yield.

Our research indicates that, historically, the coupon/ yield on a fixed income portfolio contributed more significantly to overall returns. Our research confirms prior findings, including a study by Gauthier and Goodman1 that showed 95.3% of expected fixed income returns came from the cumulative effect of duration2 positioning and credit risk. Analysis of historical return components shows that, in order to maximize the value of high yield as an investment, investors should consider focusing on maximizing exposure to yield in constructing and managing their high yield portfolio.

In our view, focusing on yield call for a more innovative approach to building a high-yield portfolio—particularly in the areas of identifying issuer quality and targeting the potential for enhanced risk-adjusted returns. We believe that high yield fixed-income factors such as value and quality—which our research suggests may provide the potential for long-term return premiums—may help improve high-yield bond portfolio construction.

A MULTI-FACTOR APPROACH TO INDEX CONSTRUCTION

The FlexShares High Yield Value-Scored Bond Index Fund (HYGV) seeks to provide investors the potential benefits of income diversification while focusing on value and quality issuers by tracking the Northern Trust High Yield Value-Scored US Corporate Bond Index (the Underlying Index)3, a custom index with what we believe is a unique multi-factor methodology. Northern Trust Investments Inc. (NTI) is the investment adviser for FlexShares ETFs.

Starting with the Northern Trust High Yield US Corporate Bond Index4, NTI first categorizes eligible credit issuers securities. Then, each issuer in those sectors receives a composite score based on the investment factors value, quality and liquidity. NTI’s value screen is a multi-metric assessment of value that incorporates both relative value and market-based valuation of default.

The quality screen examines three critical elements NTI believes offers a forward-looking assessment of creditworthiness and an issuer’s ability to pay debt obligations:

NTI’s liquidity screen is a multi-metric assessment of liquidity that incorporates such characteristics as time to maturity (e.g. time until the security reaches its maturity date as measured in years), total issuer debt outstanding (e.g. the sum of all debt outstanding for a single corporate issuer), and time since original issuance (e.g. the time that has elapsed since the security was originally issued as measured in years).

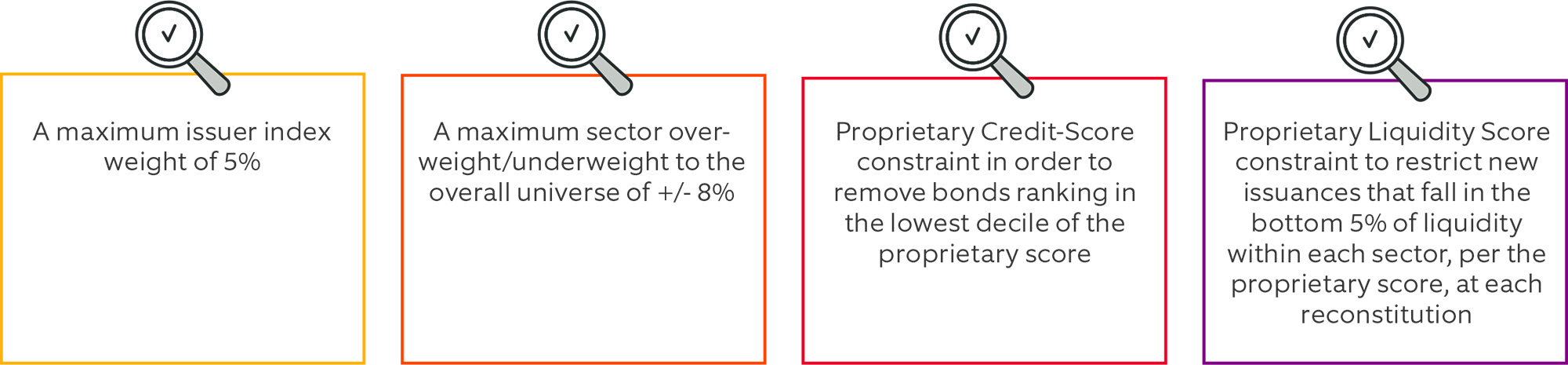

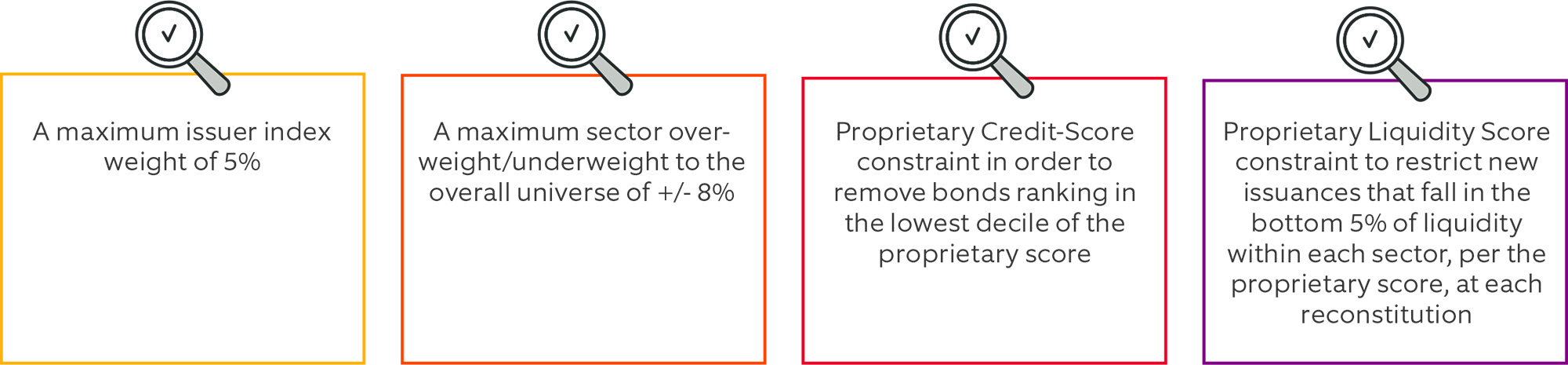

We believe optimization is further enhanced through the use of several constraints, including:

During this optimization process, the primary objective is to maximize exposure to the value-score factor relative to the eligible universe.

CREATIVE, EFFICIENT EXPOSURE TO THE HIGH YIELD CREDIT MARKET

We believe that the index’s composite value, quality and liquidity score ranking creates the potential for greater diversification and income generation, and may enhance risk-adjusted returns. Initially, high-yield ETFs were panned by legacy high-yield active managers. They predicted dire market behaviors and atypical performance outcomes due to the ETFs’ all-day trading liquidity and full price transparency. Our research suggests that those predictions have not held up with the passage of time.

Our multi-factor approach represents the kind of innovation that, in our view, is needed to help investors pursue higher levels of potential income in our current low market interest rate environment.

CONCLUSION

High yield bonds remain an important component of many investors’ fixed-income holdings, offering the potential for diversification and income generation. Low bond yields and the evolving high-yield fixed income market place have made pursuing these potential benefits more difficult. The FlexShares High Yield Value-Scored Bond Index Fund (HYGV) is designed to address the needs of these investors and the conditions of today’s fixed-income markets by employing multi-factor selection criteria and diversification controls that we believe may enhance the portfolio’s risk-adjusted returns.

FOOTNOTES

1 Risk/Return Trade-Offs on Fixed Income Asset Classes, 2003, Gauthier, Laurent, Goodman, Laurie, Fixed Income Portfolio Management – Volume 4 by Frank J. Fibozzi.

2 Duration is how sensitive your investment or a portfolio is to a change in interest rates. You will often see it expressed as a number of years – the higher the number the more volatile will be the expected change. Historically, rising interest rates have often meant falling bond prices, while declining interest rates have meant rising bond prices.

3 Northern Trust High Yield Value-Scored US Corporate Bond Index is designed to measure the performance of a diversified universe of high yield, US-dollar denominated bonds of companies exhibiting favorable fundamental qualities, market valuations and liquidity, as defined by Northern Trust Investments, Inc.’s proprietary scoring models.

4 Northern Trust High Yield US Corporate Bond Index is designed to measure the performance of a diversified universe of high yield, US dollar denominated corporate bonds issued by companies who are members of the G12 or G10 Currencies.