Investing in the real estate sector offers the potential to add growth, diversification, income along with potential protection against the risk of long-term inflation to a portfolio. We believe that a well-diversified and global approach to real estate investing is a key factor in unlocking the full range of these potential benefits.

In this paper, we discuss important considerations around global real estate investments. We then explain the methodology the underlying index uses that the FlexShares Global Quality Real Estate Index Fund (GQRE) tracks in an attempt to add breadth and diversity to an investor’s portfolio.

THE VALUE OF A GLOBAL PERSPECTIVE

Real estate equities can play an important role in a well-diversified portfolio— particularly when investors adopt a global approach.

Real estate equities can play an important role in a well-diversified portfolio— particularly when investors adopt a global approach.

Our research suggests that real estate equities have been used traditionally as a potential hedge against long-term inflation, as some types of real estate stocks have been shown to be less resistant to rising interest rates. Historically, our opinion is that real estate investments also have paid higher dividend yields than other equity classes, offering an alternative source of potential income. Finally, we believe that real estate historically has had a low correlation to both fixed income and other equity asset classes. As a result, real estate may add further diversification to an already well-diversified portfolio.

Investor demand for these investments led Standard & Poor’s in 2017 to create a new sector classification for real estate, which previously had been included in the S&P 500 index’s financials sector. As real estate’s appeal continues to grow, we believe that taking full advantage of this sector’s opportunities requires a broader focus than just U.S.-based assets. Our research suggests that a global approach to real estate investing can offer additional diversification opportunities and may include less volatility than U.S. real estate.

We also believe that a combination of a traditional market-weighted index and factor-based security selection may offer the opportunity to further mitigate risk and gain broader exposure to the potential benefits of real estate investments.

A MULTI-FACTOR APPROACH FOR A GLOBAL MARKET

The FlexShares Global Quality Real Estate Index Fund (GQRE) is an ETF that may provide an alternative source of income to investors searching for yield in a low interest rate environment. The Fund tracks the Northern Trust Global Quality Real Estate Index.1 Northern Trust Investments Inc. (NTI) is the investment adviser for FlexShares ETFs.

The FlexShares Global Quality Real Estate Index Fund (GQRE) is an ETF that may provide an alternative source of income to investors searching for yield in a low interest rate environment. The Fund tracks the Northern Trust Global Quality Real Estate Index.1 Northern Trust Investments Inc. (NTI) is the investment adviser for FlexShares ETFs.

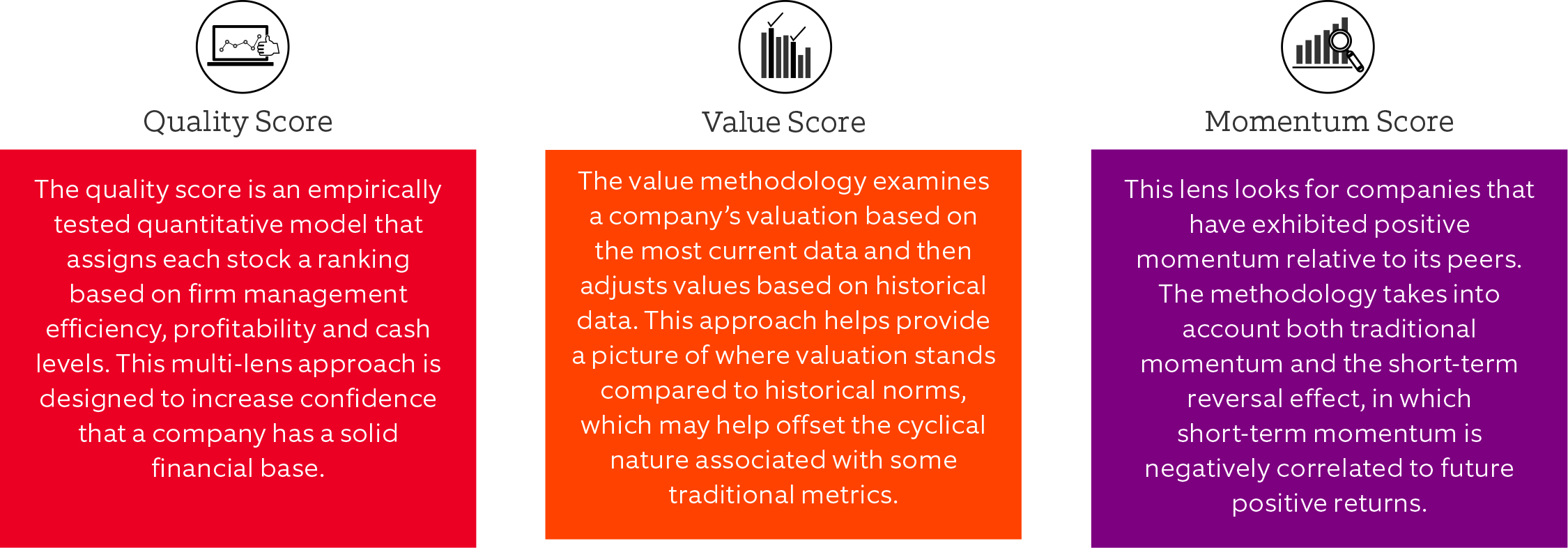

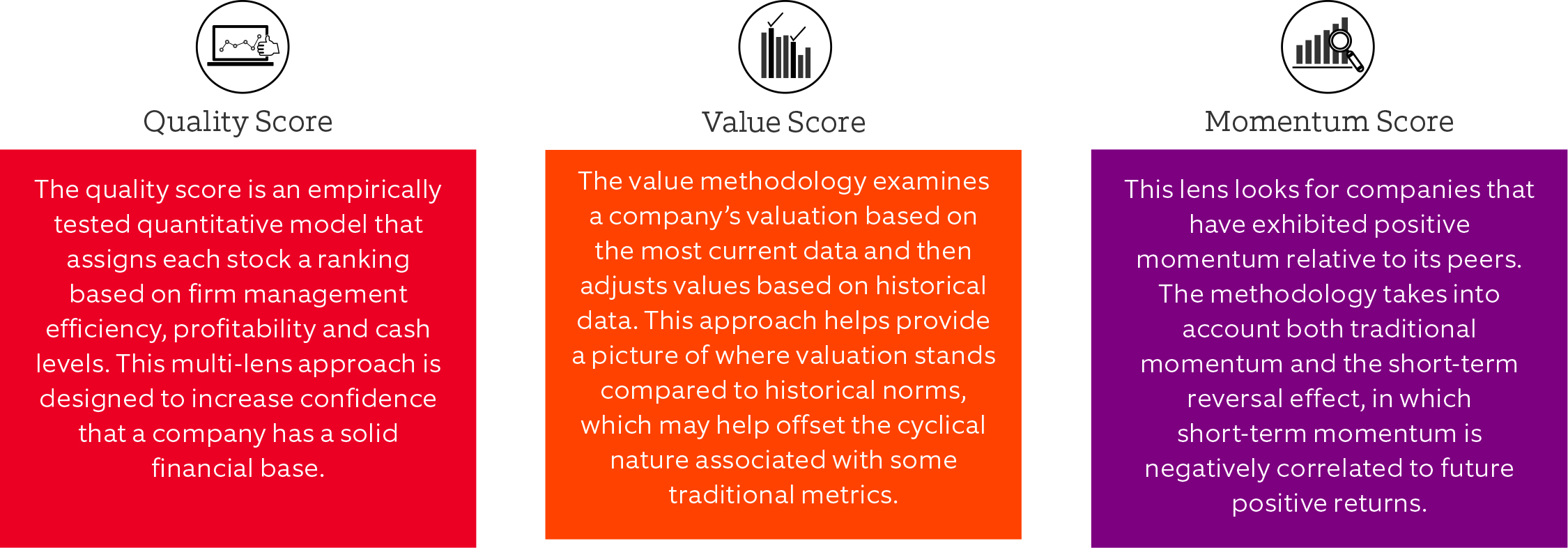

The index employs a composite score ranking to assess global real estate assets, including REITs and real estate operating trusts, in developed U.S. and international markets. NTI evaluates those assets through a multi-factor approach, which examines quality as a stand-alone factor but adds value and momentum scores in a rules-based, quantitative process:

The resulting Enhanced Quality Score is used to rank stocks in deciles, with decile 1 representing the highest scoring. All stocks in decile 5 are excluded from the index.

Next, the index applies diversification controls that include overweight/ underweight parameters, single-security maximums, and industry group, region, and country exposure. The index also minimizes style exposure and is rebalanced on a quarterly basis with a maximum targeted turnover of 12% to 15%.

During this final construction process, NTI adds another layer of optimization based on the enhanced quality score, to help provide good representation of the higher-ranking stocks within each industry, region and country.

HARNESSING THE VIRTUES OF DIVERSIFICATION

We believe the multi-factor methodology offers important benefits in the construction of the Global Quality Real Estate Fund’s underlying index. This disciplined approach recognizes that factors such as quality, value and momentum—when coupled with the use of strict parameters within the construction of the index—may help ensure proper diversification and mitigate systemic risk in the real estate sector.

We believe the multi-factor methodology offers important benefits in the construction of the Global Quality Real Estate Fund’s underlying index. This disciplined approach recognizes that factors such as quality, value and momentum—when coupled with the use of strict parameters within the construction of the index—may help ensure proper diversification and mitigate systemic risk in the real estate sector.

Global real estate also may appeal to income-oriented investors as our research suggests that dividend payments distributed by real estate investment trusts (REITS) may add to overall portfolio income.

CONCLUSION

Investors seek out real estate investments for many reasons, including as potential protection against long-term inflation and as alternative sources of potential portfolio income. But we believe the full benefits of these investments can be better captured through a broad-based global approach that includes well-established real estate markets in developed countries around the world. Expanding an investment perspective to include these global opportunities may help investors more effectively meet their objectives.

The FlexShares Global Quality Real Estate Index Fund (GQRE) is designed to provide that broad-based exposure to global real estate markets. At the same time, we believe its multi-factor approach and screening strategies aims to reduce risk and boost exposure for broader diversification and return potential.

FOOTNOTES

1. Northern Trust Global Quality Real Estate Index is designed to maximize exposure to quality, value and momentum factors, within a universe of companies operating in the real estate sector.